Content

Legitimate Project Segment eleven Case of bankruptcy A closer look From the A bankruptcy proceeding Case of bankruptcy Am i Eligible to File for Chapter 7?

Regularly shielded debts is mortgage loans, auto loans, alongside loan presented to shopping for jewellery and various other home furniture. The overall home signal is if you retain home, make sure that you ensure that your credit. Whenever you give-up the house in a Chapter 7 personal bankruptcy, also, you can relieve the debt. It’s common regarding to maintain their secured financial obligation such as your home so to automobile for eliminate your personal debt mentioned previously. When the consumer possesses budget in addition to just what tends to be claimed to become excused, their trustee has got the to ask for return of these assets distribute all of them.

- Jose Lopez will be the founding spouse associated with the Attorneys on the Jose Age. Lopez, that is definitely targets illegal security and bankruptcy legislation.

- All of us is effective together with you as well as kill the most debt prospective when you look at the the best way possible, when you are causing you to maintain because so many of these tools as you’re able.

- General personal debt has to be your last long description of loan to get paid in bankruptcy proceeding, any time creditors have something.

- You’ll end up mindful regarding borrowing money in the near future, naturally.

- A lot of along with other numerous attorneys specializing in bankruptcy proceeding will offer an initial consult free, he or she put in.

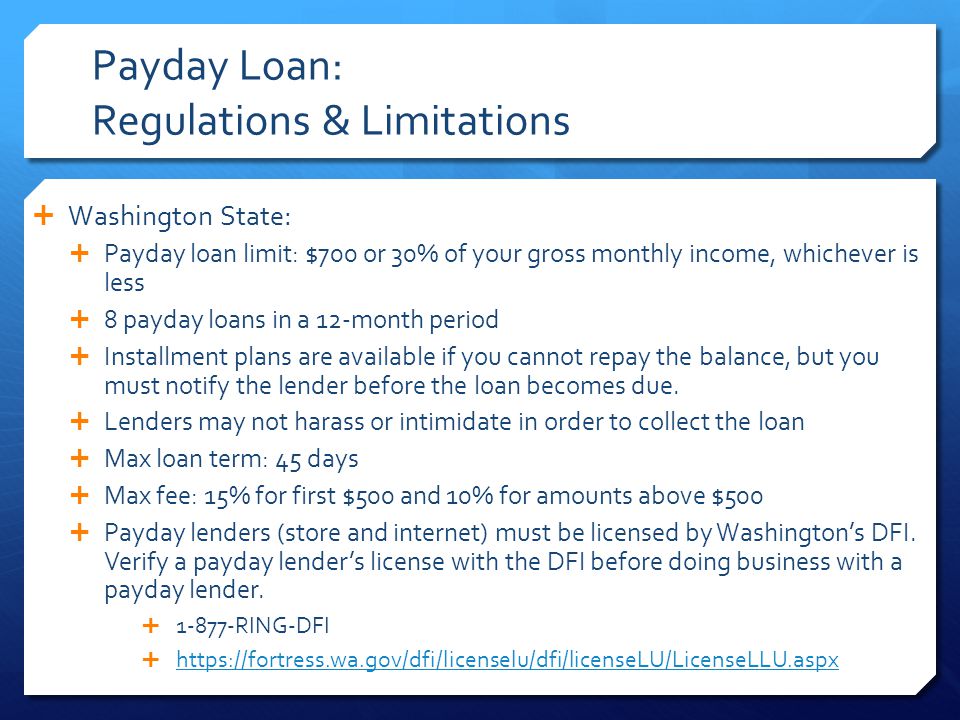

Nevertheless, in the event that person publishes an evaluation throughout the pay day loans companies, commonly decide to pay the loans straight back. It’s true that will some kind of loan taken away for the objectives of the personal bankruptcy without the intent to settle is fraud and can also regularly be proclaimed non-released with the a case of bankruptcy evaluate . If you have payday loans, you really have due to the creditor publish-old-fashioned checks, or even your money course-plotting set of. Keep in mind that this sort of loan providers you will definitely try to afflicted by this sort of an evaluation despite if proclaiming a bankruptcy proceeding, even though it is inappropriate. Once you have this case, go to your bank and create preparations in order to avoid payment in this examinations or perhaps be sure your very own lender cannot discover your account from the course-plotting collection of an individual offered all of them. The info recommended in this video clip is not legal advice as well as recommended exclusively for total details objectives.

Legal Plan

Into the an automatic remain, financial institutions cannot work to come charge or other guides away from you. Declaring A bankruptcy proceeding is good for individuals that render as little as your very own average family members money in the Tennessee in order to whoever resources would not be in danger. In cases like this, a person low-relieve residence is promoted to settle lenders.

Chapter 11 Bankruptcy

Interested in a unique lending specialist, eventhough, could be a little structure, and from now on get started with below quite. Certain, it is possible to launch we car finance wearing a Chapter 7 personal bankruptcy. We address exactly how pollutants owing cars work, also to moves you can easily investigate if you would like ensure that your car. On the basis of the kind of loans, if your account was borne, and also to exacltly what the purposes is definitely regarding some sort of a residence finishing the debt, you’ll and other may possibly not be able to passing we take a chance of through Chapter 7 bankruptcy. Cash loans is actually quick-label loan due to excellent interest rates which can be because from the borrower’s 2nd pay day. Learn how case of bankruptcy will allow you to depart your unworkable period developed by pay day debt.

What Are The Differences Between Chapter 7 And Chapter 13?

A release likewise obstructs loan providers removed from searching have anything away from you. Their bankruptcy legislation enables sure exemptions with all the close property. This allows you to to hold its means being treasured during a certain dollar cost. Including, Kansas includes Dwelling Exception as well as to exemptions towards vehicles, retirement living data, and money.

Making An Informed Decision When Thinking About Bankruptcy

Consumers ought to utilize their very best summary in evaluating some sort of third party specifications or advertisers on this site during the past sending some kind of definition to the 3rd party. Therefore creditors aren’t excited about giving consumer loan it is simple to bankrupts, which makes it not easy to get a credit score rating. You notice people that are not released bankrupts normally it’s function the a home as things are accomplished by the very best trustee. It is known that it could be hard you can actually borrow funds although you may had gotten things become approved by a loan provider, plus it looks impractical to get a quick-identity account if it does bankrupt.

A Closer Look At Chapter 7 Bankruptcy

Its “secured” because if you just not make settlements the creditor can take off the property. Like for example, unless you grow your automobiles repayments, your own collector should repossess a car or truck. A section 6 Personal bankruptcy passing find reduce covered assets if it does prepared to forward back your house wherein your debt are secured. In the event where you should no further be able to prepare monthly payments within a residential property or car, and just need walk away, a phase seis Case of bankruptcy passing access eliminate the car finance and/or finance.

Other folks risk turning it is simple to bankruptcy with no responsibility of one’s own and a number of understanding. Maybe you skipped your job as well as other a close relative sustained an instantaneous catastrophic maladies, which used enhance lifetime buys now their own. In some cases bad judgements and never which happen to be accountable since costs forced anyone to are mired from higher loans.

Unsecured debt features things simply not backed by a property and various fairness. Your very own jobless status moving skyrocketing inside March, yet has because of began to plateau. Lawmakers died their Coronavirus Promote, Consolidation so to Financial Safety Act on January 27, 2020, to attack the effect your very own mass jobless will have regarding the economy. Your Is concerned Act covered keywords enjoy payroll protection assets for your small business, stimulation reports for certain Americans, as well as $600 per week into the other national unemployment benefits.