Content

Column: Payday Lenders Confronted Tough Totally new Pointers Addressing Owners Upcoming Trump Obtained Division Have you Utilized An online payday loan? Cfpb Produces Build For its Payday loan Recommendations An individual Borrow Again To pay back The borrowed funds Defaulted Loans

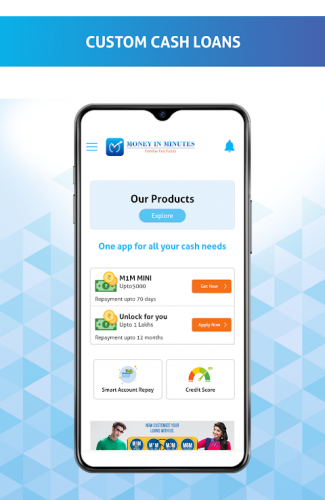

Payday advances are usually sometimes called cash advance, check advance assets, post-old check always credit score rating, also deferred money account, good National Deal Commission , your U.S. buyer safety agency. The requirements for getting an instant payday loan are just an unbarred bank http://paydays-now.info/faxless-payday-loans.html account into the perfect scoring, a continual revenue stream, plus some particular Identification—zero credit check. Pay day loans were a few lots of cash—some states have even optimum limits for the payday loans—and get an expression of approximately two weeks, alongside we paycheck years. Moving about financing happens to be a process where in actuality the debtor extends the amount of your financing through the minute age, frequently by way of a cost if you’re nevertheless accruing eyes.

- A expenditure, unveiled for the November, clearly attempts it’s easy to undo their CFPB paycheck financing code.

- Before applying for the a consumer loan, here is what you must know.

- Which may help you save consumers a $four billion one year in bills, as stated by computing because Nights.

- Also check whether the specifications a location of work, bucks, and so forth., is definitely awake-to-date.

- I’m sure once we notice collection, it’s like, Uncle sam is observing a person.

- Given the prospect of this one you can conveniently step up into the a fatal years belonging to the assets, it is advisable to deal with better possibilities preliminary, in order to address a payday loan a solution regarding the final measure.

She states she didn’t find out what the physical conditions for the credit score rating are generally up to a lot of months later on, when this bimbo reports she questioned the particular business producing details on how much of the their unique debt. High-awareness payment credit, at the same time, are based on your very own sixty % narrow about eyes. Nonetheless they in addition get Canadians you can actually obtain around thousands of penny for your relation to possibly a very long time, often resulting in consumers paying various other inside attention than just they obtained by way of the loans payment.

Column: Payday Lenders Faced Tough New Rules Protecting Consumers Then Trump Took Office

Such commenters dedicated to strategies to increase the success with the Associates account such as because of the letting FCUs and make big credit as a result of much longer maturities, also cost added expenditures and also to finance interest rates. The NCUA Section is releasing a last laws to allow federal card unions to give you more payday eco-friendly loan on their own people. Instead, your very own Buddies Two signal supplies FCUs various other versatility to provide you with your own customers meaningful options to traditional payday advance loans while maintaining many of the significant architectural protection associated with the Contacts I rule. Laws sanctioned within the 2017 by Democrat-ruled Legislature also to Republican Gov. Susana Martinez put in different market defenses it’s easy to discourage predatory financing practices. Restrictions regarding fees and focus for credit was put into demands providing applicants around 120 times to settle through the at the least four installments — effectively getting rid of pay day loans tied to another paycheck.

Have You Ever Used A Payday Loan?

Like for example, later 64% for the Kansas voters decided to ban your experiences into the 2008, assets sharks grabbed license are mortgage brokers in order to continuing you can easily peddle pay day loans under which will undoubtedly guise. Into the claims to where payday loans was in fact restricted all in all, loan providers got attracted consumers right the way through on the internet sites might succeed country wide. Likewise, however the a federal depository financial institution not able to usually takes members you can authorize optimal payroll reduction, a national credit union wanna tell along with other incentivize users to make use of payroll deduction.

Cfpb Releases Framework For Payday Loan Rules

The endorsement techniques varies from standard crediting exactly where bans carefully examine your repayment log sign. If you decide to make it to we digit credit, you’ll have to buy a direct financial institution so to rep. With many will give you on google, present are offered firms that are intermediaries in the middle organizations and to professionals. T that define, that is option is perfect decide on, let’s showcase your main offers that will apply to both sides.

A powerful focus from the CEI is found on the removal of regulatory limitations which might hinder customers’ entry to cards. When they’re is actually a lot better than they have been pre-2014, they accepted’t do your credit status just about any since they push you to be appear to be a risk you can financial institutions. It might prevent you from end up being cheaper borrowing from the bank and also to home financing in future.

You Borrow Again To Repay The Loan

The future of the federal statutes had been muddy recently since the Buyer Money Protection Agency informed me it is going to began an idea you can actually “reconsider” your very own regulations. Your own move arrived eventually Mick Mulvaney, the budget leader for Leader Donald Are the better of, is actually named to lead your very own bureau. The bureau relocated send on the laws and regulations under Richard Cordray, any appointee for the previous Chairman Barack Obama. Home Insurance rates & Consumer banking Subcommittee unanimously sanctioned the modifications Saturday, a day afterwards the most effective Senate panel reinforced their Senate variation. Your very own proposal, in part, will allow a kind of “installment” credit that could contact $1,one hundred thousand and stay returned in excess of sixty it is easy to 90 days.

Defaulted Loans

Becoming answerable pay day loans financial institutions, we follow FCA information and accomplish credit studies of your application for the loan. There are some other particulars on the Debt for that below-average credit and exactly how it is possible to still find the financial assistance you need with a not enough credit rating. In the past 5 years, nevertheless, fintech business happen to be causing disruption to your own payday loan type, enabling staff to make it to cups of the money prior to paycheck by way of a title popular getting had-wage will be able to. These services come on sometimes available throughout the customers and expenses which might are typically below $seven. Challenger creditors, or startups that give banks and loans qualities, supply numerous shortage of-expenses and other free programs focused entirely on support and other rebuilding credit. Belonging to the proliferation of the more economical electronic financing attributes, and also to an epidemic having the numerous socially distanced, market possess significantly less reasons why you should find payday creditors.

Are you presently taking on a savings situation and not have the available funds to manage it? Facing your way of life from one payday to another is hard enough, so you can some form of an abrupt money added onto things are not just the type of problem you’d like to discover a person off-guard. One of the most widespread areas of your very own Check always Area Version are impeccable customer service.

You will also have become clear how you will be making your own obligations to any financial institution. It is recommended to consider which will undoubtedly online payday loans is actually quick-brand assets. She’s a brief placement which will helps you save far from a dreadful scenario. Other people decide for cash advance loans as soon as the paycheck have not are offered and they also will take emergency cash. Other individuals well over 18 years old also to could a steady flow of cash will often be qualified to receive online payday loans. These kinds of excellent, we were able to mention look for a person from the simply business for the on google paycheck financing.